Our Approach

What is Financial Life Planning?

First and foremost, you are treated like a friend, not an account number. We know it's not easy to talk about saving, budgeting, paying off debt and planning for retirement. We spend time figuring out the emotional reasons you are here. We learn how and why you and your family's feelings and goals for your money drive your short- and long-term decisions.

How? We take a financial life planning approach that puts your interests first. We focus on increasing your sense of financial well-being and life satisfaction. Initially, this process will help you to clarify your values, priorities, circumstances, and aspirations; and then guide you in defining and designing your unique version of the “rich life.”

Financial life planning will also increase your understanding of the habits and attitudes that facilitate your financial and life goals and support successful life transitions. Whether you're just getting started and planning for a distant retirement, getting married, saving for your first house, helping pay for your children's education or finally, preparing to retire, we'll guide you along the way.

Why Choose a Financial Life Planning Advisor?

Because of the unpredictability of life and the complexity of financial markets, it is important to work with a financial advisor who will help you pursue your financial and life goals. And, it is essential to select an advisor who will take the time to truly get to know you and to understand your concerns and your dreams.

Rising to this challenge is a small, but growing, cadre of life-centered financial professionals like ours who are leaders in the trend of integrating financial planning and life planning. That means we are dedicated to understanding each client's unique set of values, priorities, challenges, and opportunities in order to make the most appropriate financial recommendations.

Therefore, in addition to traditional discussions of assets and net worth, we try to ask the unconventional questions like, “What will bring meaning and purpose to your financial life?” If you are among those individuals disillusioned with the results of “using your life to make money,” you will find the opposite mind set of “using your money to make a life” to be both liberating and compelling.

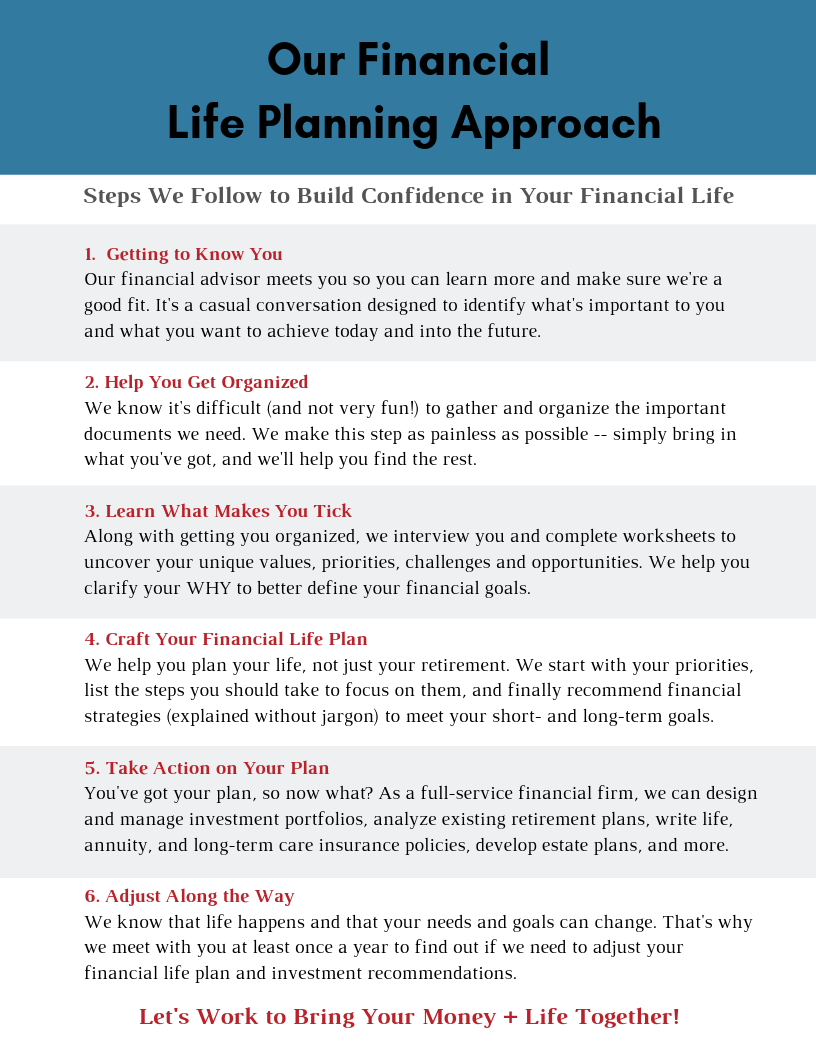

Learn more about the steps we follow to building confidence in your financial life.